Early Indicators of a Global Economic Fracture: Clarity Beyond Reassuring Narratives

Von Timo Braun – veröffentlicht durch den Ethical Council of Humanity

When leading economic agencies present “no recession signalled” narratives, history shows that this is often not reassurance, but the moment a structural shift is already underway. This communication pattern – soft wording under stress – is documented across multiple economic turning points.1

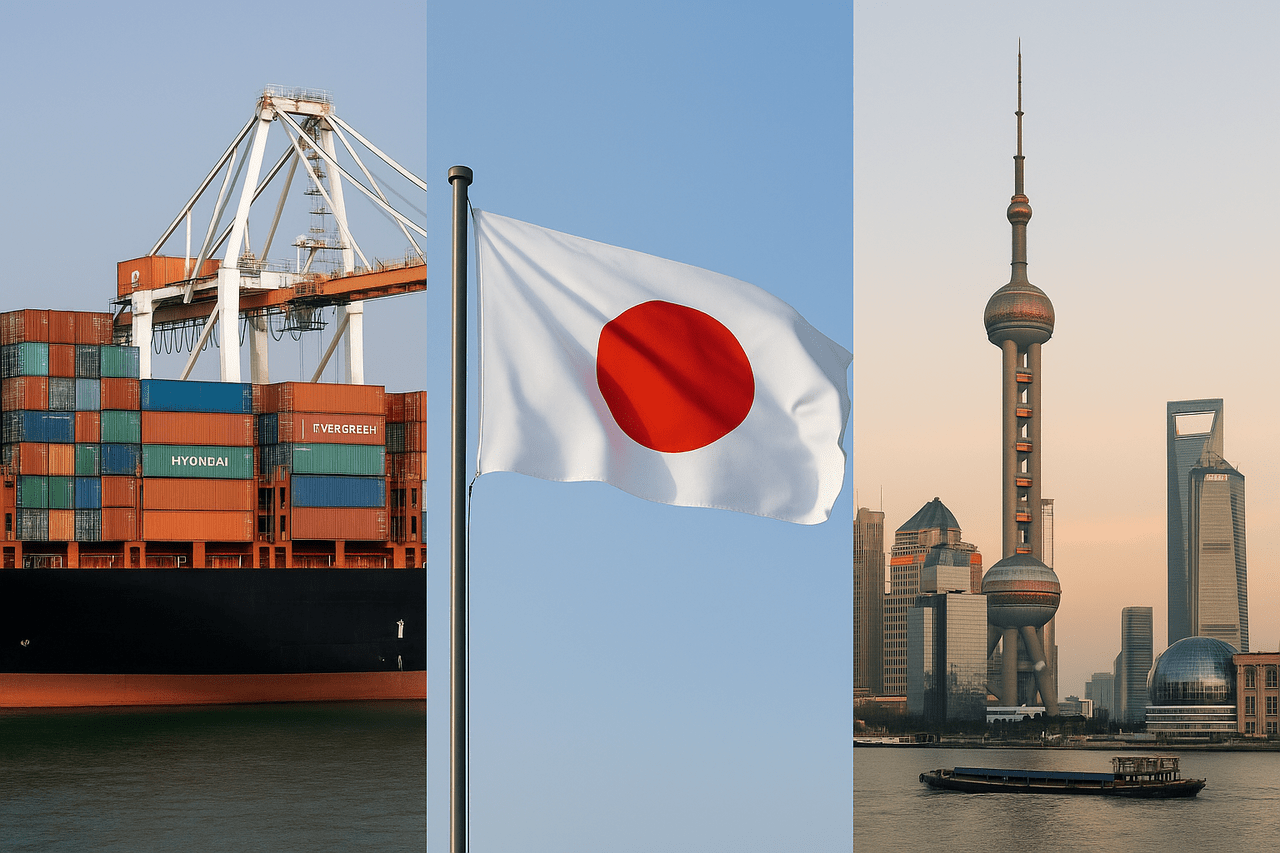

The latest data from Japan, China and global logistics aligns precisely with this pattern.

1. Japan: Contraction Despite Reassuring Language

Japan recorded its first economic contraction in six quarters in Q3 2025:

Public commentary continued to frame the decline as “temporary”, despite indicators suggesting underlying structural stress.4

Such discrepancies between data and narrative are typical early-phase signals in past global slowdowns.

2. China: The Industrial Core Slips Below the Growth Threshold

China’s official manufacturing PMI reached 49.8 in September 2025 – below the expansion threshold of 50.5

Additional indicators include:

- declining industrial electricity load

- weakening export orders

- reduced credit impulse

- slowing domestic demand

The IMF continues to call China the largest single contributor to global growth, while acknowledging mounting structural vulnerabilities.6

When China decelerates, global momentum responds.

3. Global Logistics: Containers, Freight Rates and Maritime Transport

The Baltic Dry Index (BDI) showed repeated weakness in 2025, with forward freight agreements pricing in further declines due to lower demand and deflationary pressures in China.7

According to the OECD and UNCTAD, the pattern is clear:

- After a price spike in late 2024, container freight rates fell again and remained highly volatile throughout 2025.8

- Global maritime trade is projected to grow only 0.5% in 2025, and containerised trade just 1.4% – a near-stagnation compared to previous years, described by UNCTAD as “trade under pressure”.9

This is not a local disturbance. It reflects a global deceleration of the trade and production cycle.

4. Why Soft-Wording Functions as a Warning Signal

During earlier crises (e.g., 2007’s “subprime issues are contained”), verbal reassurance masked the fact that underlying indicators had already turned negative.10

Typical reasons include:

- maintaining political stability

- preventing market panic

- avoiding public alarm

- institutional inertia

Data, however, remains unaffected by rhetoric.

5. Orientation, Not Helplessness: What Matters Now

5.1 Daily Early Indicators (5 minutes)

- PMI readings (China, Japan, EU, US)

- Baltic Dry Index

- container prices & volumes

- China industrial electricity load

- semiconductor export data (Japan/Taiwan)

5.2 Practical Stability Measures

- avoid impulsive financial decisions

- maintain 2–3 months of liquidity

- monitor local supply and cost structures

- adopt a disciplined information diet (10–15 minutes/day, indicator-based)

5.3 Psychological Stability

Clarity stabilises the nervous system. Panic arises from information noise, not from facts.

Conclusion

The simultaneous weakness across:

- Japan (industry & exports)

- China (production & demand)

- global logistics (BDI, container trade)

shows that we are not dealing with a short-term fluctuation, but with a structural transition phase of the global economic organism.

When narratives reassure while indicators deteriorate, one conclusion emerges:

The transition has already begun. Those who follow real indicators remain capable of action.

Footnotes

Documented communication patterns in economic downturns; typical “soft-wording” behaviour in stress phases across major news agencies. ↩

TradingEconomics: Japan GDP contraction Q3 2025 –0.4% q/q. ↩

TradingEconomics: Japan annualised GDP decline –1.8%. ↩

Reuters commentary citing economists: “temporary setback rather than the start of a recession”. ↩

China Manufacturing PMI September 2025: 49.8 (National Bureau of Statistics of China). ↩

IMF outlook: China remains key driver of global growth with rising structural risks. ↩

Baltic Exchange: BDI weakness and FFA market expectations for declining rates due to demand reduction & China deflation. ↩

OECD: container freight rate dynamics, volatility and decline after 2024 price spike. ↩

UNCTAD Review of Maritime Transport 2025: maritime trade +0.5%, container trade +1.4%, “trade under pressure”. ↩

Historical crisis narrative pattern: 2007 Federal Reserve statement “subprime issues are contained”. ↩